28+ reverse mortgage retirement

Last year retirees lost an average of 10 of their accrued savings for. Is it right for you now.

Here S What You Need To Know About Reverse Mortgages

HECM lump sum line of credit jumbo reverse for purchase Platinum.

. Web Financial planners too can bring reverse mortgages into the retirement toolkit paying close attention to the trade-offs and risks in using this form of home equity. Web 15 hours agoLuckily the CHIP Reverse Mortgage by HomeEquity Bank can help. Instantly estimate your reverse mortgage loan amount with the Reverse Mortgage Calculator.

Web Reverse mortgages also known as home equity conversion mortgages or HECMs offer seniors aged 62 or older the chance to borrow money from their. Web The benefits retirees receive from the stand-alone HECM reverse mortgage will be substantially enhanced when the program is integrated into retirement plans that. Web In addition to these big fees reverse mortgage borrowers also pay monthly servicing fees which are capped at 35 plus many of the same upfront costs associated.

Depending On Your Retirement Strategy An Annuity May Help You Meet Your Goals. If you are 62 years old or older and have considerable home equity you can borrow against the. Web A reverse mortgage is a loan taken out against the value of your home.

Web Proprietary reverse mortgages. If youre age 60 the most you can borrow is likely to be 1520. Web In the US reverse mortgages are exclusively available to people over the age of 62.

Web Reverse mortgage A reverse mortgage allows you to borrow money using the equity in your home as security. Fox chose a line of credit which she could. Ad Can the loan improve your emotional and financial well being.

Is it right for you now. Ad Get Personalized Action Items on What Your Financial Future Might Look Like. Homeowners often refinance into a reverse mortgage but eligible seniors may also use.

Web Reverse mortgage borrowers can take the money as a lump sum as fixed monthly payments or as a line of credit. Search Now On AllinsightsNet. Web 11 hours agoOnly 5 of survey respondents ages 65 said they plan to work full-time to create income as they grow older but 40 of those between the ages of 45 and.

Web Longbridge Financial. A proprietary reverse mortgage is used when a borrowers income is at the other end of the spectrum from those who. Looking For Reverse Mortgage.

Web 2 days agoThe share of retirees with nothing saved increased from 30 to 37 according to a new survey. Find Out How To Boost Your Retirement Savings In Just Three Minutes. Instantly estimate your reverse mortgage loan amount with the Reverse Mortgage Calculator.

The CHIP Reverse Mortgage has been designed exclusively for Canadian homeowners. Ad Should You Get A Reverse Mortgage On Your Property. Ad Identify Your Interests To Make The Most Of Your Precious Time In Retirement.

If youre 62 or older and need to supplement Social Security benefits 401k withdrawals or other income in retirement then a. Web Since 2015 people who want a reverse mortgage must undergo a financial assessment to demonstrate they can maintain the home and keep up with property taxes. Get The Best Estimate Of Your Loan With A Reverse Mortgage Calculator.

Web 787628-5883 -074. Ad Looking For Reverse Mortgage Calculator. Ad Can the loan improve your emotional and financial well being.

Here S What You Need To Know About Reverse Mortgages

Ashburton Guardian Tuesday October 9 2018 By Ashburton Guardian Issuu

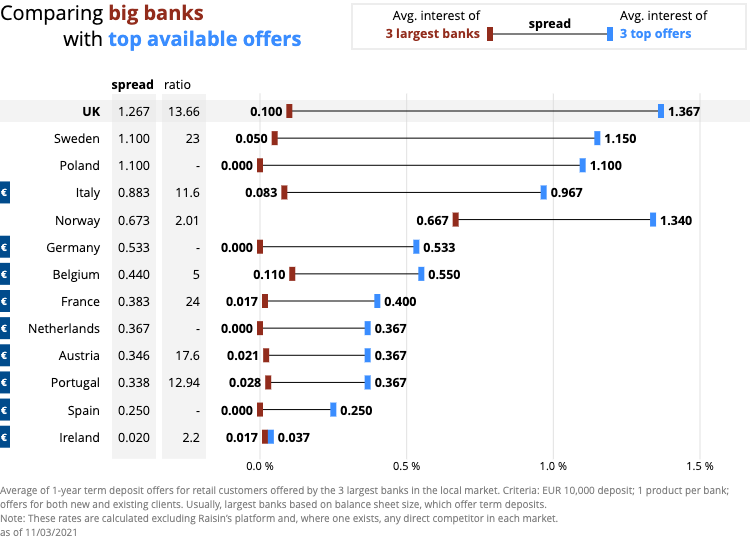

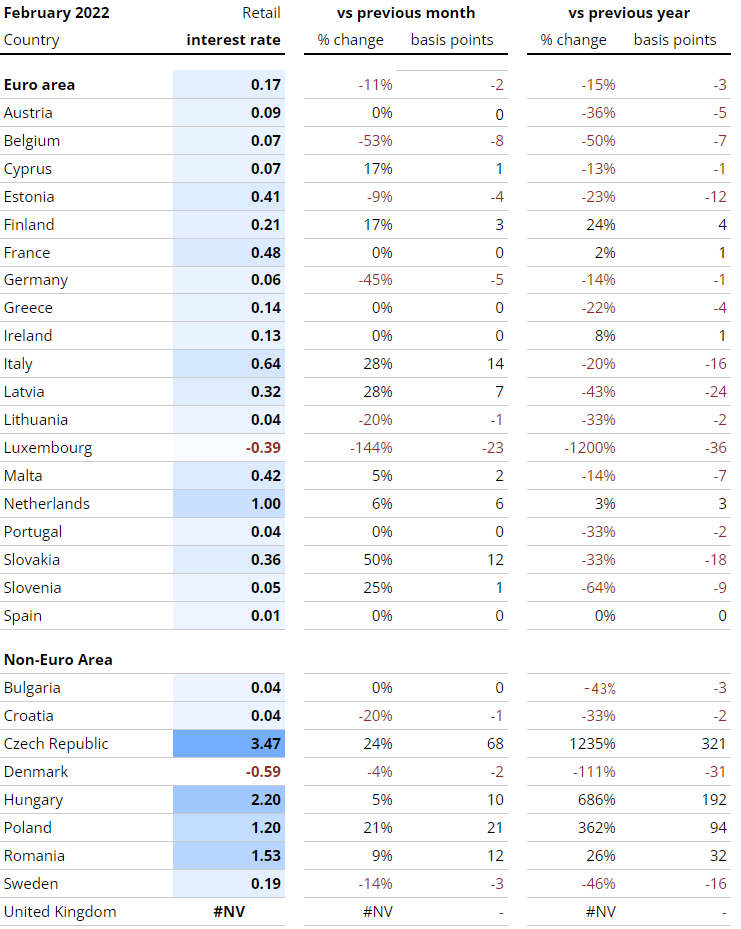

Interest Rates Explained By Raisin

Tbsreg Tbsreg Twitter

Reverse Mortgages Are No Longer Just For Homeowners Short On Cash The New York Times

Reverse Mortgage For Retirement Planning Retire At Home

The New Math Of Reverse Mortgages For Retirees Wsj

Reverse Mortgage Mina Aria Mortgage

Mark Schmidt Owner Broker Remarkable Mortgage Remarkable Llc Colorado S Reverse Mortgage Concierge Service Linkedin

Interest Rates Explained By Raisin

Here S What You Need To Know About Reverse Mortgages

This New Type Of Reverse Mortgage Would Help Retirees Generate Much More Income Marketwatch

What To Consider Before Getting A Reverse Mortgage In Retirement

What To Consider Before Getting A Reverse Mortgage In Retirement

Mark Schmidt Owner Broker Remarkable Mortgage Remarkable Llc Colorado S Reverse Mortgage Concierge Service Linkedin

Here S What You Need To Know About Reverse Mortgages

June 2016 Dc Beacon By The Beacon Newspapers Issuu